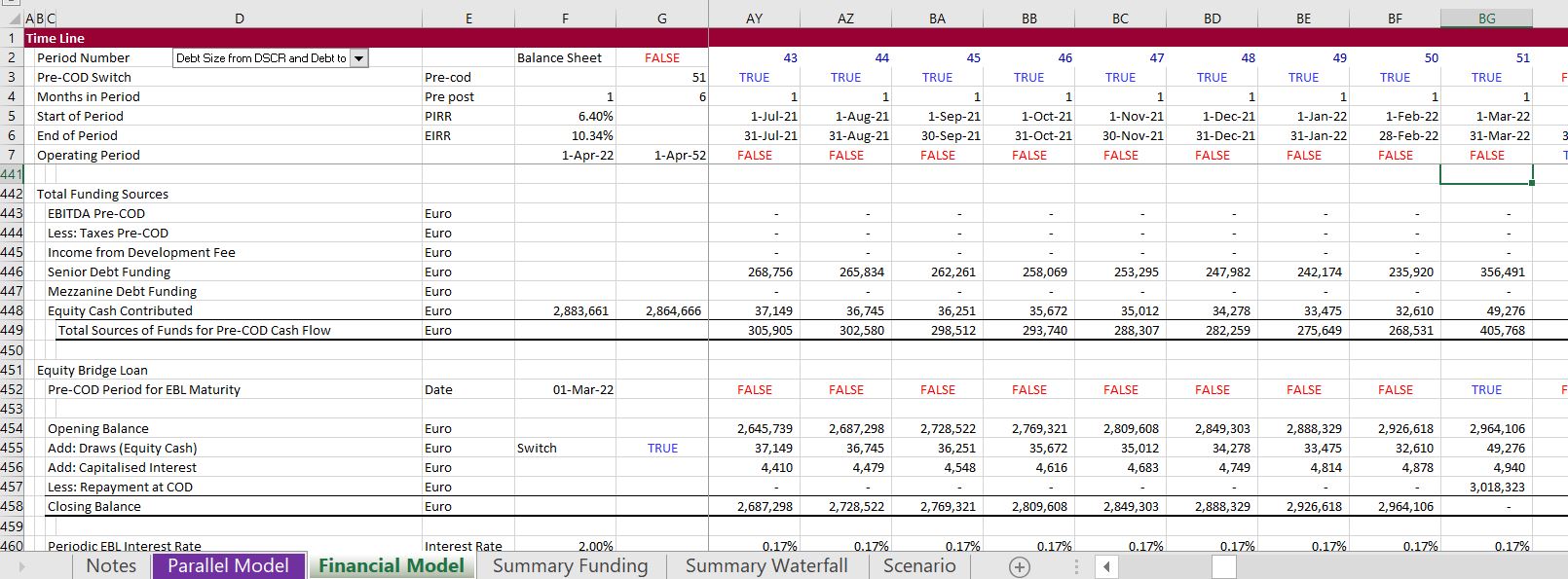

Equity Bridge Financing | Within a very short time, your bridge loan will be approved. The borrower took it down to. Sometimes companies do not want to incur debt with high interest. Bridge financing is a term that gets thrown around a lot. Why is bridge financing for startups important? Let's say the closing date for your current home is 90 days away, while the closing date for your new home is in just 35 days. Se questo è il caso, le società possono cercare imprese di capitali di rischio per un finanziamento di ponti per finanziare il capitale finché non possa aumentare un più ampio finanziamento azionario. Decentralized finance meets financial derivatives. The benefit of equity financing to a business is that the money received doesn't have to be repaid. A bridge loan is a temporary financing option designed to help homeowners bridge the gap between the time your existing home is sold and your new property is purchased. Bridge financing is a term that gets thrown around a lot. Enterprise value is the value of the operational business, independent of capital structure. Bridge financing loans in new york. 1 954 просмотра 1,9 тыс. Bridge loans (also called commercial mortgage bridge loans, bridge loans, bridge financing, and construction bridge loans) are often a necessary tool for quickly taking advantage of a as detailed below, cmbls require a larger percentage of borrower equity than commercial construction loans. More expensive than a home equity loan. Understandably, some companies want to avoid high interest debts so decide to seek out equity bridge financing. Within a very short time, your bridge loan will be approved. If your original home fails to. Shows that can easily be added to financial model if the interest on ebl is not part of financing calculations of the project. The stress of handling two mortgages at once plus the bridge loan interest. Let's say the closing date for your current home is 90 days away, while the closing date for your new home is in just 35 days. This is where a venture capital firm provides the company with capital in the form of a bridge financing round to tide them over while they raise equity. Enterprise value is the value of the operational business, independent of capital structure. A volte le aziende non vogliono sopportare debiti con un alto interesse. For example, let's say you are purchasing a $350,000 home. More expensive than a home equity loan. Why is bridge financing for startups important? Equity swaps have only existed for legacy markets before, allowing parties to enter into a contract to swap future financial gains in any asset or stock. Home equity loans are one of the most popular alternatives to bridge loans. Ipo bridge financing is used by companies going public. Equity bridge capital recently financed the purchase and rehab work done on this newly listed $2.2m san francisco property. If the company fails, the funds raised aren't companies also have to make a number of decisions about equity financing, including the types of shares to offer (common, preferred or voting), pricing, who to. It enables you to use the equity in your current home to pay the down payment on your next home. Why is bridge financing for startups important? Shows that can easily be added to financial model if the interest on ebl is not part of financing calculations of the project. When should you use bridge funding for your businesses? How bridge financing is calculated. 1 954 просмотра 1,9 тыс. A volte le aziende non vogliono sopportare debiti con un alto interesse. Bridge loans exist to meet immediate cash flow needs during the time between a demand for cash and its availability. Bridge loans can save the day when you're buying and selling a home at the same time, but they can be risky. With and equity bridge loan, a lender allows the sponsor of the project to borrow the amount of equity invested in the project. For example, getting from a seed round to series a. The video below describes modelling of an equity bridge loan in the context of a brazilian wind farm financed by bndes. The borrower took it down to. Understandably, some companies want to avoid high interest debts so decide to seek out equity bridge financing. If your original home fails to. Equity bridge capital recently financed the purchase and rehab work done on this newly listed $2.2m san francisco property. Ipo bridge financing is used by companies going public. Equity swaps have only existed for legacy markets before, allowing parties to enter into a contract to swap future financial gains in any asset or stock. More expensive than a home equity loan. This is where a venture capital firm provides the company with capital in the form of a bridge financing round to tide them over while they raise equity. With and equity bridge loan, a lender allows the sponsor of the project to borrow the amount of equity invested in the project. For example, let's say you are purchasing a $350,000 home. Bridge financing loans in new york. Equity value (or market capitalization) is the value attributable to the owners or shareholders (frequently expressed on a per. Equity bridge financing requires giving up a stake in the company in exchange for financing. Bridge finance allows you to get into stock positions without selling your crypto assets.

Equity Bridge Financing: How bridge financing is calculated.

Source: Equity Bridge Financing

0 Komentar:

Post a Comment